Lines are Available 24/7

Se Habla Español

Lines are Available 24/7

Se Habla Español

Lines are Available 24/7

Se Habla Español

Probate is the Court supervised process of distributing a decedent’s assets to their rightful heirs or beneficiaries. A beneficiary is someone entitled to take assets pursuant to a will or estate planning tool. On the other hand, an heir takes possession of property by virtue of a legal right or kinship to the decedent. Probate procedure is governed by both the substantive laws contained in Florida’s probate code and the procedure rules contained in the Florida Rules of Civil procedure. Florida has several different types of probate that are ideally suited for different situations. If your estate is large and has significant creditor issues generally Florida’s Formal Administration Probate will be the most appropriate procedure. Alternatively, if your estate is small and the assets and debts of the estate are straight forward, you may qualify for Florida’s Summary Administration Probate procedure or even for a disposition without Administration. For more information on the procedural requirements for Summary Administration or Formal Administration, visit our other Probate pages designated for those types of Florida Probates. What follows is a basic overview of some of the substantive concepts relevant to all Florida Probates.

Essentially Probate assets are assets that belong to the estate. Much of modern estate planning attempts to use revocable living trusts and other mechanisms for avoiding the Probate process. As someone who frequently encounters family members dealing with deceit and theft of inheritance and otherwise, I can tell you that sometimes it benefits everyone to have the rules of Probate and the Courts involved. Some assets, like life insurance policies, annuities and IRAs may have a specific designation to a particular person upon the decedent’s death. If so, these assets pass to that particular individual outside of Probate. Additionally, if you simply maintain accounts with a transfer-on-death (TOD) or payable-on-death (POD) designation, they will not be subject to probate. Tricks like that can allow some people to obtain assets without Court supervision. By far the most common reason people need to open a Florida probate is to dispose of Florida property. Whatever the case, if you are unsure of whether the asset needs to go into probate, you need to determine whether you can get access to it without a Court Order. If not, you need to go through probate. Finally, cars and mobile homes can pass inside and outside of probate. The Florida Department of motor vehicles has alternate pathways to obtain new title outside of the Probate Court process so long as you can submit sworn affidavits. These Florida Highway and Safety Motor Vehicle Forms can be accessed on our blog by clicking here.

If someone dies with a will in Florida they are said to have passed away testate. The original will needs to be deposited with the Clerk of Court within 15 days pursuant to Florida law. The appropriate Clerk of Court depends on the appropriate venue or locale where the Probate should be initiated. Florida law has a priority scheme but generally you are looking for County where the decedent was domiciled at the time of their passing. Once you have deposited the original of the Will you must examine it to determine whether the document complies with Florida law. The document must be signed in the presence of two witnesses, signed by the witnesses and also notarized. Additionally, Florida law has a provision known as a self-proving affidavit. This is an additional affidavit stuck to the back of a will where the testator affirms that he/she has executed what is his or her last known will and testament. While this may be simply a silly formality, Florida Probate law allows wills with a self-proving affidavit to be automatically admitted to probate. That means that the Court will automatically accept wills with a self-proving affidavit to the Probate Court. Without this affidavit, the witnesses or the personal representative named in the will must submit and oath affirming the validity of the will at a local Courthouse. This process is slows down a Florida Probate and just creates an additional hurdle.

A will also typically appoints a Personal Representative, known as an executor in some areas, this is a person designated by the decedent to manage the estate and wrap up its affairs. When a probate is initiated this person will have preference in appointment to become the designated individual for purposes of creating an estate account, settling creditor claims and ultimately seeing to the proper distribution of the assets, all under the supervision of the Probate Judge, subject to the Florida Rules of Probate and the Florida Probate Code.

In Florida, if someone dies with a Will, their surviving spouse is entitled to a minimum of the assets in the estate. This base amount and the surviving spouse’s right to enforce the minimum are known as the elective share. So no matter what a will says, a surviving spouse pursuant to Fla. Stat. 732.2065 is entitled to at minimum 30 Percent of the elective estate.

If you pass away in Florida without a will, the State of Florida uses a default set of rules to determine how your estate will be distributed. This is known as Florida’s rules of intestate succession. The distribution scheme is codified in Florida law, at Fla. Stat. 732.103. Here is the statutory default scheme for Florida:

(1) to the surviving spouse and descendants;

(2) to the surviving spouse in absence of descendants;

(3) to the descendants in the absence of a surviving spouse;

(4) if there is no descendant, to the father and mother or the survivor of them;

(5) if there is none of the foregoing, to the brothers and sisters and the descendants of deceased brothers and sisters;

(6) if there is none of the foregoing, in halves to the decedent’s paternal and maternal kindred in the specified order by

statute; and

(7) if there is no kindred of either part, the whole of the property goes to the kindred of the last deceased spouse of the decedent as if the deceased spouse had survived the decedent and then died intestate entitled to the estate.

Ok so generally to your spouse and decedents and your relatives. This assumes of course that the estate has more assets than debt. So if you’re survived by a spouse and children (lineal descendants), your assets will pass to them. The rationale behind these default rules is that is what most people intend to do within their estate planning. Assuming that you had no will and died with both a surviving spouse and children and children from a prior marriage in Florida? Your probate assets would be distributed among your heirs is a specific way. The proportionate shares are laid out as follows:

I. Surviving Spouse’s Share of Intestate Estate: (Fla. Stat. 732.102)

The intestate share of the surviving spouse is:

(1) If there is no surviving descendant of the decedent, the entire intestate estate.

(2) If the decedent is survived by one or more descendants, all of whom are also descendants of the surviving spouse, and the surviving spouse has no other descendant, the entire intestate estate.

(3) If there are one or more surviving descendants of the decedent who are not lineal descendants of the surviving spouse, one-half of the intestate estate.

(4) If there are one or more surviving descendants of the decedent, all of whom are also descendants of the surviving spouse, and the surviving spouse has one or more descendants who are not descendants of the decedent, one-half of the intestate estate.

In other words, assuming the decedent had a surviving spouse and died without a will, if there are no children the spouse inherits everything. If there are children of the deceased who are also the children of the surviving spouse, the surviving spouse inherits everything. Now when you involve step-children who are not the children of both the surviving spouse and the decedent, the surviving spouse will inherit ½ and the lineal descendants of the deceased will inherit the remaining ½.

II. Distribution among the Lineal Descendants Per Stirpes

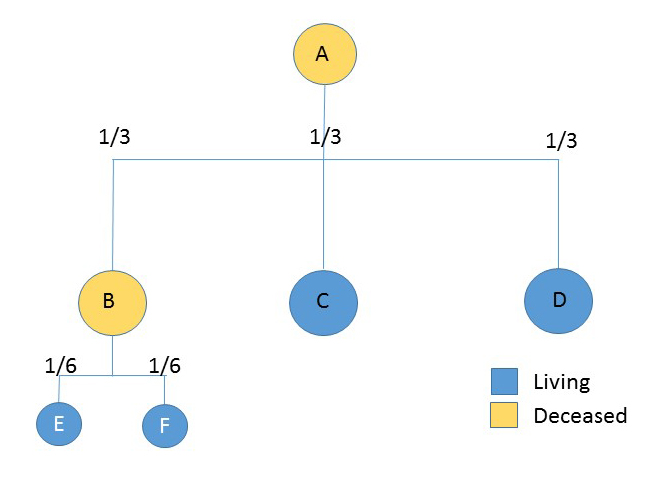

Assuming further that in your Florida Probate, because of your family structure the surviving spouse does not take the entire probate estate. The remaining amount to be distributed to the lineal descendants is distributed “Per Stirpes.” This is an old latin term that translates into “by the branch.” For purposes of Florida Probate, that means that among heirs the default intestate rules attempt to provide distribution equally according to lineal relationship in the family tree. Per Stirpes distribution also allows children of a deceased issue to take in their parent’s place. For example:

Person A passes away without a surviving spouse but is survived by three children, B, C and D. At the time of A’s passing child B has passed away but before his passing he had two children (A’s grandchildren). The estate would be distributed into equal 1/3 shares to B, C, D. Since B predeceased A, his children would each take ½ of the 1/3 share (equal to 1/6) of the overall estate.

Florida Statute 732.103 provides the distribution scheme for intestate assets as follows:

The part of the intestate estate not passing to the surviving spouse under s. 732.102, or the entire intestate estate if there is no surviving spouse, descends as follows:

(1) To the descendants of the decedent.

(2) If there is no descendant, to the decedent’s father and mother equally, or to the survivor of them.

(3) If there is none of the foregoing, to the decedent’s brothers and sisters and the descendants of deceased brothers and sisters.

(4) If there is none of the foregoing, the estate shall be divided, one-half of which shall go to the decedent’s paternal, and the other half to the decedent’s maternal, kindred in the following order:

(a) To the grandfather and grandmother equally, or to the survivor of them.

(b) If there is no grandfather or grandmother, to uncles and aunts and descendants of deceased uncles and aunts of the decedent.

(c) If there is either no paternal kindred or no maternal kindred, the estate shall go to the other kindred who survive, in the order stated above.

(5) If there is no kindred of either part, the whole of the property shall go to the kindred of the last deceased spouse of the decedent as if the deceased spouse had survived the decedent and then died intestate entitled to the estate.

(6) If none of the foregoing, and if any of the descendants of the decedent’s great-grandparents were Holocaust victims as defined in s. 626.9543(3)(a), including such victims in countries cooperating with the discriminatory policies of Nazi Germany, then to the descendants of the great-grandparents. The court shall allow any such descendant to meet a reasonable, not unduly restrictive, standard of proof to substantiate his or her lineage. This subsection only applies to escheated property and shall cease to be effective for proceedings filed after December 31, 2004.

Mr. Zoecklein’s primary focus centers on Probate and Plaintiff’s Civil Litigation. His esteemed team is actively handling cases across the State of Florida in the areas of probate administration, estate litigation, insurance claims, and business law. Hailing from Blacksburg, Virginia, he graduated cum laude from Virginia Tech with a degree in business management, successfully running multiple franchises in Virginia and North Carolina during his time there. Pursuing higher education, Mr. Zoecklein earned his juris doctorate degree cum laude, along with a Masters in Business Administration, from Stetson University College of Law, where he notably represented the university in numerous national and international legal academic competitions. A highlight of his law school journey was winning a National Moot Court competition for Stetson, displaying his exceptional legal acumen. During his time at Stetson, Brice also contributed to the Center for Advocacy of Elder Law and interned at the U.S. Attorney’s Office for the Middle District of Florida. Following graduation, he embarked on a career with a prominent insurance defense firm, but his passion for Plaintiff advocacy and consumer justice led him to dedicate his legal pursuits exclusively to the representation of consumer rights. Apart from his professional endeavors, Mr. Zoecklein treasures quality time with his wife and three children. Through his unwavering pursuit of justice, both inside and outside the courtroom, Brice Zoecklein exemplifies the essence of a compassionate advocate and a reputable professional, dedicated to upholding the values of integrity, empathy, and fairness in all aspects of his life.

Stetson University College of Law – cum laude

Virginia Polytechnic Institute – cum laude

Mr. Zoecklein and Zoecklein Law are currently litigating cases in the following practice areas:

Email: Brice@zoeckleinlawpa.com

Tampa Office: (813) 993-4967

Lakeland Office: (863) 808-0530

Sarasota: (941) 313-3330

Mrs. Zoecklein is a highly accomplished and driven professional with a successful track record in both accounting and customer service. As a devoted spouse and parent to three wonderful children, She values the importance of work-life balance and strives to lead by example in maintaining a fulfilling family life alongside her career.

With an innate sense of self-drive and ambition, Mrs. Zoecklein has consistently demonstrated exceptional leadership and organizational skills, making her an invaluable asset to every team she has been a part of. Drawing from her experience in accounting, she has managed financial operations with precision and an eye for detail, ensuring smooth financial transactions and accurate record-keeping.

In the realm of customer service, Mrs. Zoecklein has honed her communication and interpersonal skills, establishing strong rapport with clients and colleagues alike. She takes great pride in delivering exceptional service, consistently exceeding expectations, and ensuring client satisfaction.

Outside of her professional pursuits, Mrs. Zoecklein finds immense joy in the company of her loving spouse and three children. She believes that family forms the cornerstone of a fulfilling life and embraces opportunities to create lasting memories with them. Whether it’s embarking on adventurous outings, engaging in creative endeavors, or simply relishing quality time at home.

With a perfect blend of professional dedication and family-centered values Mrs. Zoecklein embodies a well-rounded and driven individual, whose commitment to excellence extends to both her career and the cherished relationships that enrich her life.

A Florida Bar licensed attorney since 2011 with a passion for justice, a track record of successful courtroom and jury trial experience, and a diverse background that extends beyond the legal world. As a past assistant state attorney and co-owner of a successful online business, I bring a unique blend of legal expertise and entrepreneurial spirit to everything I do.

My dedication to the well-being of the community began with my service in the U.S. Army Reserve, evolved into keeping drunk drivers off the street, and is now focused on helping people find closure during difficult times, putting loved ones to rest, and mitigating the injustices of the legal system.

I grew up in Tampa, Florida, and after 2 years at the American University in Washington, D.C., I returned to the state and graduated with honors from the University of Florida with a degree in history. I received my Juris Doctor from the University of Maine. After deciding New England winters were too gloomy, I returned to the state for a second time. When I am not working, I cherish spending time with my wife and our pets.

Mr. Rubin currently focuses on probate administration, estate litigation, and general civil litigation. Mr. Rubin grew up in Miami, Florida, and graduated from the University of Miami where he obtained a Bachelor’s of Science in Communications.

Mr. Rubin obtained his juris doctorate degree from Florida International University College of Law in Miami, Florida. While at Florida International University, Mr. Rubin was a member of the Negotiation and Mediation Team, and competed in several competitions, including the Tulane Law School Professional Football Negotiation Competition. While at Florida International University, Mr. Rubin interned at the Miami-Dade State Attorney’s Office and the Broward Public Defender’s Office.

After graduating, Mr. Rubin worked at the Fort Myers Public Defender’s Office as an Assistant Public Defender, and then worked for Florida Rural Legal Services, where he focused on family and immigration law. Mr. Rubin joined Zoecklein Law, P.A. in July of 2023. While not working, Mr. Rubin enjoys spending time with his girlfriend and their three cats, four spiders, one snake, and one scorpion.