The creation of a Last Will and Testament is a tool to alter your estate plan from the default rules of succession. If you happen to pass away without having written a Last Will and Testament, the State of Florida has an estate plan for you and these are detailed in the Florida Rules of Intestate Succession. Also if you have died without a will you have died intestate.

Florida Statutes, Chapter 732 covers intestate succession. The intestate rules will also apply to a Last Will and Testament that doesn’t cover all of a decedent’s property. Fla. Stat. 732.101. Assuming that the decedent did not create a Last Will and Testament at all the family structure of the deceased, as applied to the Florida Rules of Intestate succession determines who gets what.

- The Spousal Share in a Florida Intestate Probate Proceeding

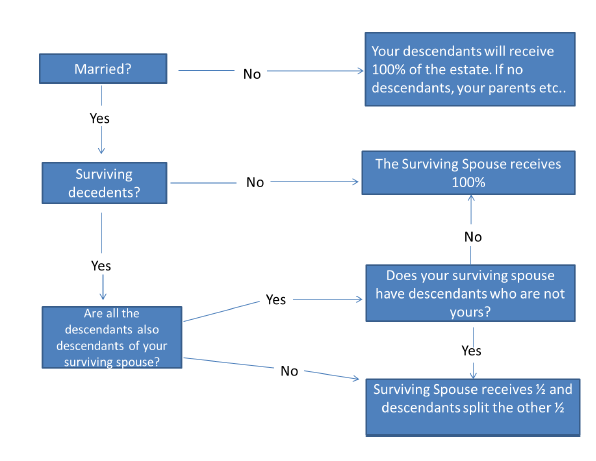

First, was the deceased survived by a spouse? If the answer is yes than the spouse is entitled to a significant portion of the intestate estate. The spousal share will be depend on whether the deceased had children who were not related to the surviving spouse. Fla. Stat. 732.102. The idea being that a spouse who is the blood parent of the surviving children will likely look out for those kids from the assets received when he or she dies and conversely that in a step-parent situation, you may need to protect the children from the non-blood spouse. Fla. Stat. 732.102 provides:

732.102 Spouse’s share of intestate estate.—The intestate share of the surviving spouse is:

(1) If there is no surviving descendant of the decedent, the entire intestate estate.

(2) If the decedent is survived by one or more descendants, all of whom are also descendants of the surviving spouse, and the surviving spouse has no other descendant, the entire intestate estate.

(3) If there are one or more surviving descendants of the decedent who are not lineal descendants of the surviving spouse, one-half of the intestate estate.

(4) If there are one or more surviving descendants of the decedent, all of whom are also descendants of the surviving spouse, and the surviving spouse has one or more descendants who are not descendants of the decedent, one-half of the intestate estate.

So if the decedent had any kids that were not the kids of the surviving spouse, the spouse gets only ½ of the estate. Alternatively, if there are no children or if the children of the decedent were also children of the surviving spouse, then the surviving spouse gets the entire intestate estate. Fla. Stat. 732.102. See the chart below for reference.

- Florida’s Intestate Share Rules for other Heirs

In order to divide the share not going to the spouse Florida Statutes provide a set order of intestacy to determine the proper beneficiaries. Fla. Stat. 732.103.

732.103 Share of other heirs.—The part of the intestate estate not passing to the surviving spouse under s. 732.102, or the entire intestate estate if there is no surviving spouse, descends as follows:

(1) To the descendants of the decedent.

(2) If there is no descendant, to the decedent’s father and mother equally, or to the survivor of them.

(3) If there is none of the foregoing, to the decedent’s brothers and sisters and the descendants of deceased brothers and sisters.

(4) If there is none of the foregoing, the estate shall be divided, one-half of which shall go to the decedent’s paternal, and the other half to the decedent’s maternal, kindred in the following order:

(a) To the grandfather and grandmother equally, or to the survivor of them.

(b) If there is no grandfather or grandmother, to uncles and aunts and descendants of deceased uncles and aunts of the decedent.

(c) If there is either no paternal kindred or no maternal kindred, the estate shall go to the other kindred who survive, in the order stated above.

(5) If there is no kindred of either part, the whole of the property shall go to the kindred of the last deceased spouse of the decedent as if the deceased spouse had survived the decedent and then died intestate entitled to the estate.

(6) If none of the foregoing, and if any of the descendants of the decedent’s great-grandparents were Holocaust victims as defined in s. 626.9543(3)(a), including such victims in countries cooperating with the discriminatory policies of Nazi Germany, then to the descendants of the great-grandparents. The court shall allow any such descendant to meet a reasonable, not unduly restrictive, standard of proof to substantiate his or her lineage. This subsection only applies to escheated property and shall cease to be effective for proceedings filed after December 31, 2004.

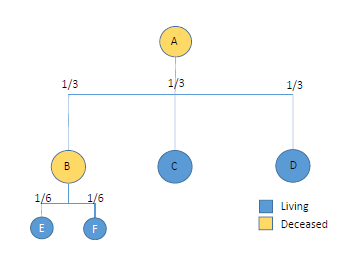

So the first layer is lineal descendants. That can be children, grand children or great-grandchildren. Florida follows a per-stirpes method which means that each branch of descendants can take for their family members who may have predeceased the decedent.

For example, assume A had three sons, B, C & D. Child B passes away before A but had his own children E & F, who are the grandchildren of A. If A dies, (assuming no spouse), his estate would be split between E &F who takes the place B’s share equally and the other interests go to C and D.

The next layer after lineal descendants are to the deceased mother and father equally or to the survivor of them, and then to siblings or survivors of siblings. If none of those family members were living at the time of the death of the decedent then we go all the way to the descendants of the decedent’s grandparents.

Understanding who gets what during an intestate proceeding is a fundamental concept for Probate Administration in Florida. The lack of a Last Will and Testament does not make a probate necessary that would otherwise be unnecessary but for a Will. It simply means that the Probate Court will use the default rules of distribution instead of the decedent’s directives in a Last Will and Testament. If you have questions about an estate proceeding or how to move forward with the transfer of assets through a Florida Probate give us a call. We offer no obligation consultations designed to inform you and your family about this process.

Disclaimer: The information contained in this blog/website is for informational purposes only and provides general information about the law but not specific advice. This information should not be used as a substitute for advice from competent legal counsel as laws change and the facts in your specific case need to be analyzed.